Employee Social Security Payroll Tax Deferral

This article is about how to pay back CARES act payroll tax deferrals. In the amount of 93460 an employee would not receive the Social Security tax deferral.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

The GSA Payroll Team has been informed.

Employee social security payroll tax deferral. On August 28 2020 the Internal Revenue Service issued IRS Notice 2020-65 PDF. Nearly all businesses and self-employed individuals were eligible for the employer payroll tax deferral. Hello there BMax.

As per the IRS to repay the deferred taxes employers can make the deferral payments through the Electronic Federal Tax Payment System or by credit or debit card money order or with a check. Social Security Payroll Tax Deferral UPDATE. Notice 2020-65 authorizes the deferral of the 62 percent of employee-paid Social Security tax and railroad retirement tax equivalent on the first 137700 of wages for payroll tax.

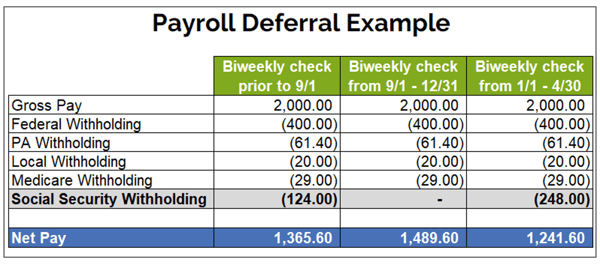

Add a payroll item. Employers may defer the employee portion of Social Security payroll taxes for any employee whose wages as defined for Social Security purposes are less than 4000 for a biweekly period. Soon EFTPS will have a new option to choose deferral payment in which the employer selects deferral payment and then changes the date to the applicable tax period for the.

The Coronavirus Aid Relief and Economic Security Act CARES Act let employers defer payment of the employers portion of the Social Security tax see IRS Notice 2020-65 This was NOT free money like the PPP Loan. Go to the Employees menu then Manage Payroll ItemsThen select New Payroll Item. All 2020 deferred amounts.

Each pay date Cherry had a total of 62 percent of 399231 or 24752 of FICA taxers deferred. When does the deferral apply. Select Custom Setup then select Next.

Payroll tax withholding deferral for USDA employees In light of the ongoing COVID-19 pandemic a presidential memorandum was issued on Aug. As previously explained the employee Social Security tax deferral is available only in those biweekly payroll periods that the employees wages are less than 4000 or the equivalent amount for pay periods other than biweekly. The CARES Act allows employers to defer paying their portion of Social Security taxes through December 31 2020.

IRS Notice 2020-65 PDF allowed employers to defer withholding and payment of the employees Social Security taxes on certain wages paid in calendar year 2020. The other half is due December 31 2022. The IRS on Aug.

Companies are required to back these deferred taxes. Set up payroll items to track the deferral. What is the Social Security Tax Deferral.

Once you determine that you will offer to defer the tax and your employee opts in youll need to set up the payroll item to track this Social Security deferral on paychecks. The 62 employer portion of social security taxes that would otherwise be due between March 27 2020 and January 1 2021 can be deferred. The provision lets you defer payment of the employer share 50 of Social Security taxes on.

This notice provides instructions on the deferral delayed collection of the employees portion 62 of the old-age survivors and disability insurance OASDI tax obligations. 1 2020 through Dec. The Consolidated Appropriations Act 2021 was passed and extended the period for collecting deferred 2020 Social Security taxes.

Since Cherrys 2020 bi-weekly Social Security wages were less than 4000 Cherry was subject to employee FICA tax deferral for the period 912020 through 12312020. 28 issued guidance on the tax deferral plan but questions remained over numerous issues including whether employees could have a say in opting in or out. The deferral enables the employee portion of Social Security tax assessed on compensation paid.

To give people a needed temporary financial boost the Coronavirus Aid Relief and Economic Security Act allowed employers to defer payment of the employers share of Social Security tax. 8 2020 directing the Secretary of the Treasury to defer social security payroll tax withholdings for eligible employees during the period of Sept. An equivalent amount for self-employed individuals is also eligible for deferral.

One-half of the amount deferred is due December 31 2021. So if you remember take yourself back. For the period 912020 through 12312020 there were 9 pay dates.

However if the employee earned overtime or any other premium pays bonuses etc. The period for collection is now January 1 2021 through December 31 2021 instead of.

Social Security Payroll Tax Deferral Is Mandatory For Military Members And Civilian Employees You Cannot Opt Out So Plan Accordingly Navy

What Federal Employees Need To Know About The Current Payroll Tax Withholding Deferral Federal Employee Education Assistance Fund

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

What Are Employee And Employer Payroll Taxes Ask Gusto

Irs Releases Instructions For Forms W 2 And W 2c Reporting Of Employee Deferral And Repayment Of Social Security Taxes Under Irs Notice 2020 65

How To Defer Social Security Tax Covid 19 Bench Accounting

Irs Defers Employee Payroll Taxes Jones Day

Information On Social Security Oasdi Tax Deferment Sixteenth Air Force Br Air Forces Cyber News

The Payroll Tax Deferral Dilemma Blogs Labor Employment Law Perspectives Foley Lardner Llp

Us Deferral Of Employee Fica Tax Help Center

Cares Act Payroll Tax Deferrals And R D Credits

Https Nfc Usda Gov Clientservices Hr Payroll Docs Payroll Tax Deferral Faqs Pdf

Lack Of Guidance Leaves Employers Uncertain About Payroll Tax Deferral

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Us Deferral Of Employee Fica Tax Help Center

Payroll Tax Deferral How Will It Affect You Experian

What Employees Need To Know About The Social Security Payroll Tax Deferral

Pros Cons Of President Trump S Payroll Tax Deferral

Update Period Extended For Collecting Deferred 2020 Social Security Taxes Wright Patterson Afb Article Display

Post a Comment for "Employee Social Security Payroll Tax Deferral"