Is Employer Social Security Included In Ppp

And expenses paid with the proceeds of a PPP loan that is forgiven are tax-deductible. As a result payroll costs are not reduced by taxes imposed on an employee and required to be withheld by the employer but payroll costs do not include the employers share of payroll taxes.

Paycheck Protection Program Round 2 Knowns Unknowns Rkl Llp

The deferral of deposits of the employer portion of Social Security tax was established by the CARES Act as applicable only to deposit deadlines from March 27 to Dec.

Is employer social security included in ppp. For example employer contributions to a retirement plan that are used for PPP loan forgiveness are also deductible by the business. If youve already applied for. Employers who have received a PPP loan but whose loan has not yet been forgiven may defer deposit and payment of the employers share of Social Security tax that otherwise would be required to be made beginning on March 27 2020 through the date the lender issues a decision to forgive the loan in accordance with paragraph g of section 1106 of the CARES Act without incurring.

Employee federal income taxes withheld by the employer are not deducted from SBA Gross Pay The following are not considered payroll costs under the CARES Act. While the term has not yet been defined in any guidance it uses a different calculation for owner-employees At this point we believe that term refers to individuals who are sole. Yes covered payroll costs include paid sick family vacation and medical leaves except for payments to employees for leave covered under the Families First Coronavirus Response Act.

Payments for healthcare benefits for employees. Next while federal unemployment FUTA and Social SecurityMedicare taxes are excluded from eligible payroll costs state unemployment SUTA and other state or local employer-paid payroll taxes may be included. I reviewed an SBA webinar last month and the SBA representative said that if our business an S Corporation had not yet paid its employers match yet for our 401K participants for 2019 and since we have extended our 2019 Corporate Tax Return until September 2020 the SBA representative said that the 2019 Employer Matching Contributions would be included in the PPP forgiveness amount.

The Social Security tax deferral is not a payroll tax credit. Q Is the employee portion of federal income tax social security and Medicare included in wages. Payments for retirement benefits.

Employers that received a Paycheck Protection Program loan may not defer the deposit and payment of the employers share of Social Security tax that is otherwise due after the employer receives a decision from the lender that the loan was forgiven. Instead its a benefit under the CARES Act offered in addition to the Employee Retention Credit and the FFCRA tax credit. Q Our PPP loan was based on calendar 2019 which include all bonuses for the year.

The new guidance clarified for the first time that employer-paid FICA Social Security and Medicare should not be included in the payroll costs calculation. This allowed up to 5000 per employee as a tax credit against Social Security wages. The mere receipt of a PPP loan by an employer does not limit the employers ability to use the deferral and the limitation triggered only when the principal of the loan is partially or totally forgiven.

As of 2021 PPP loans will cover additional expenses including operations expenditures property damage costs supplier costs and. However the employers portion of federal payroll taxes such as Social Security and Medicare are not included in payroll costs and similarly PPP loan funds cannot be used to pay the employers portion of federal payroll taxes. Employers are still required to submit the employers portion of federal payroll taxes to the IRS.

For example an employee who earned 4000 per month in gross wages from which 500 in federal taxes was withheld would count as 4000 in payroll costs. State and local taxes on employee compensation. As a result payroll costs are not reduced by taxes imposed on an employee and required to be withheld by the employer but payroll costs do not include the employers share of payroll tax.

The amount of the deposit and payment of the employers share of Social Security tax that was deferred through the date the PPP loan is forgiven. Payroll costs include salaries wages leave payments severance payments payments of group health benefits and retirement benefits and payments of compensation-related taxes but exclude among other items i compensation in excess of 100000 for any individual employee on an annual basis ii Social Security Medicare and income withholding taxes and iii compensation paid to. Employer Social Security tax deferral Under the CARES Act employers can defer payments for the employer portion of their Social Security tax liability.

Forgiven PPP loans will not be included as taxable income. 31 2020 with half of the deferred. Employee benefits including paid time off for vacation family medical or sick leave.

Can I bonus now based on an average of what their bonuses. Employee gross pay that exceeds 100000 The employer portion of federal employment taxes ie Social Security and Medicare Payments to independent contractors. An update to the Act PPP Flexibility Act allowed the PPP and Employee Payroll Retention Tax.

The CARES Act also created the Employee Payroll Retention Tax Credit. Paycheck Protection Program loan recipients are now eligible to defer deposit and payment of the employers share of social security tax until the employer receives a decision from its lender that the loan is forgiven. That stance has changed under the Act.

The highlight from this latest round of clarification. Can I spend all of the PPP loan proceeds on non-payroll costs.

Ppp Flexibility Act What You Need To Know Bench Accounting

Ppp Applicable Payroll Costs Report For Loan Forgiveness Asap Help Center

Ppp Average Monthly Payroll Report Asap Help Center

Ppp Round 2 Sole Proprietor Guide To Eligibility Application

The Latest On Ppp Loan Forgiveness What Financial Executives Need To Know Fei

Do S And Don Ts Of Using Ppp Loan Funds Texas Citizens Bank

Faqs On The Paycheck Protection Program Ppp For Food Service And Accommodation Franchisees White Case Llp

Good News For Ppp Loan Recipients Deferrals For Employer Portion Of Social Security Tax Now Available Employment Law And Litigation

Pin On Online Payroll Services

Ppp Forgiveness Misuse Of Funds C2 Essentials Inc

Ppp Loan Forgiveness Checklist Morrison Foerster Llp Government Contracts Insights Jdsupra

Providers Can Now Get More Money From The Ppp Tom Copeland S Taking Care Of Business

Everything Ppp Borrowers Need To Know About Why The Sba S 75 Rule Is Wrong

Paycheck Protection Program Ppp Qualified Expenses

Can I Claim The Ertc If I Received A Ppp Loan

Sba Paycheck Protection Program For Businesses First United

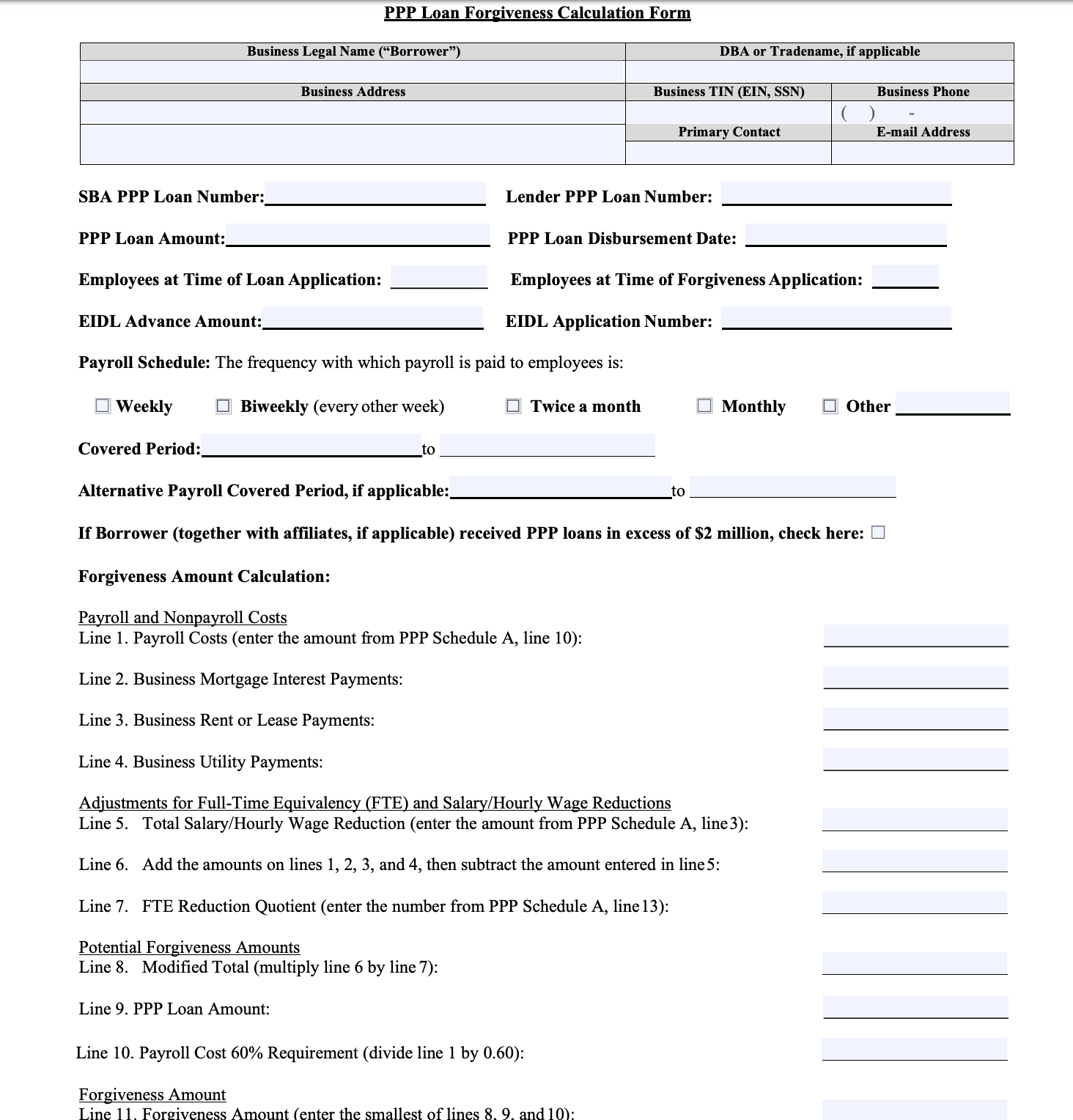

How To Fill Out Your Ppp Forgiveness Application Form Simplifi Payroll And Hr

Post a Comment for "Is Employer Social Security Included In Ppp"