Social Security Employee Tax Maximum

Refer to Whats New in Publication 15 for the current wage limit for social security wages. If You Work More Than One Job Keep the wage base in mind if you work for more than one employer.

What Are Employee And Employer Payroll Taxes Ask Gusto

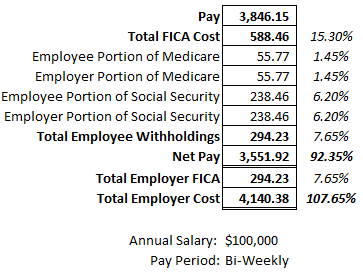

For 2021 an employee will pay.

Social security employee tax maximum. 62 Social Security tax on the first 142800 of wages maximum tax is 885360 62 of 142800 plus 145 Medicare tax on the first 200000 of wages 250000 for joint returns. Updated December 05 2016 -- For Administrators and Employees. 125000 for married taxpayers filing a separate return plus.

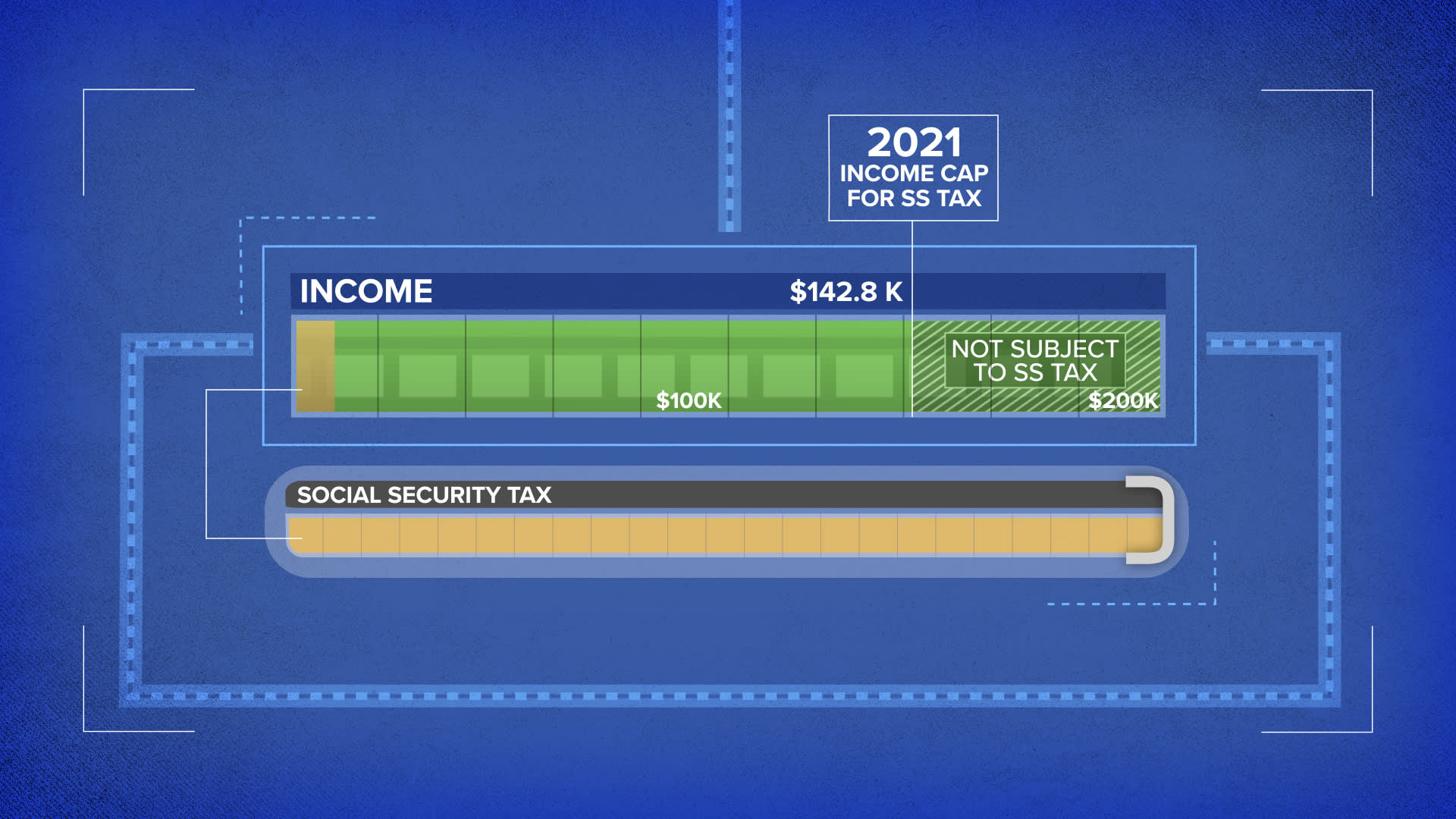

The Social Security tax is an income-capped flat tax. Also as of January 2013 individuals with earned income of more than 200000 250000 for married couples filing jointly pay an additional 09 percent in. It applies to all earned income up to the maximum taxable earnings.

125000 for married taxpayers filing a separate return plus. The Medicare portion HI is 145 on all earnings. Or Publication 51 for agricultural employers.

Corporate tax rates indirect tax rates individual income and employee social security rates and you can try our interactive tax rates tool to compare tax rates by country jurisdiction or. As its name suggests the Social Security tax goes to the Social Security program. If youve already met the annual wage base limit for Social Security with a previous employer in a given year you can contact a tax advisor to recover any excess tax paid on your personal returns.

If youre self-employed youll pay the total 124 though you can deduct half on your tax. 21 Tax on income Employees must pay wage withholding tax and social security contributions on their income or benefits. In this update you will find more information regarding the applicable Dutch social security contributions per 1 January 2021.

Employers deduct the tax from paychecks and match it so that 124 goes to the program for each employee. This is an increase of 27900 from 796080 in 2018. 62 Social Security tax on the first 132900 of wages maximum tax is 823980 62 of 132900 plus 145 Medicare tax on the first 200000 of wages 250000 for joint returns.

Additionally employers that have employees who are covered by the Dutch social security scheme have to pay contributions in the Netherlands. The Social Security portion OASDI is 620 on earnings up to the applicable taxable maximum amount see below. The wage base limit is the maximum wage thats subject to the tax for that year.

Schedule SE line 7 is the maximum amount of combined wages and self-employment earnings subject to social security tax or the 62 portion of the 765 railroad retirement tier 1 tax for 2020. Since employees also have the Social Security payroll tax withheld from their wages salaries etc the employer is in effect matching each employees Social Security payroll tax. Employee Social Security Tax Rates.

The employer must withhold and pay the wage tax. For taxes due in 2021 refer to the Social Security income maximum of 137700 as youre filing for the 2020 tax year. The maximum taxable earnings amount is.

Data is also available for. Employer Social Security Tax Rates. For 2019 an employee will pay.

The maximum Social Security tax employees and employers will each pay in 2019 is 823980. For 2020 the first 137700 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self-employment tax Social Security tax or railroad. The employer social security rates tax table provides a view of tax rates around the world.

Data is also available for. The 765 tax rate is the combined rate for Social Security and Medicare. For the original question wouldnt the total of all sources of income mean.

Hence the maximum amount of the employers Social Security tax for each employee in 2021 is 885360 62 X 142800. If youve earned 69000 from one job and 69000 from the other youve crossed over the wage base threshold. However your current employer is still require to withhold and pay Social Security.

The Social Security wage base for self-employed individuals in 2019 will also be 132900. The employee social security rates tax table provides a view of tax rates around the world. Corporate tax rates indirect tax rates individual income and employer social security rates and you can try our interactive tax rates tool to compare tax rates by country jurisdiction or.

For 2021 it amounts to 62 on all income up to 142800. They must both give notify this to the Tax Administration. Although the income tax and social security contribution are levied together there are different rules applicable to determine if a Dutch resident employee is liable for social security contributions.

Employers and employees may elect voluntarily to designate their relationship for wage tax purposes as employment. Only the social security tax has a wage base limit. It is not considered as an income tax although it can be experienced in this way since the tax authorities are collecting the social security contribution together with the income tax.

These contributions are determined on an annual basis. For earnings in 2021 this base is 142800.

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

Your Bullsh T Free Guide To Taxes In Germany

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Social Security Wage Base Increases To 142 800 For 2021

Your Bullsh T Free Guide To Taxes In Germany

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Social Security Tax Cap 2021 Here S How Much You Will Pay

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

A Small Business Guide To Medicare Taxes In 2021 The Blueprint

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Your Bullsh T Free Guide To Taxes In Germany

Social Security Tax Cap 2021 Here S How Much You Will Pay

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Post a Comment for "Social Security Employee Tax Maximum"