Can You Defer Payroll Taxes And Get A Ppp Loan

This has created a lot of uncertainty because many businesses are not sure if they can obtain a PPP loan even if they can find a bank. The US Small Business Administration released guidance Wednesday clarifying that lenders must recognize the previously established extended deferral period for payments on the principal interest and fees on all Paycheck Protection Program PPP loans even if the executed promissory note indicates only a six-month deferral.

Nov 13 Ppp Loan Forgiveness Underway Not As Chaotic As Application Period Covid 19 Fwbusiness Com

Payroll tax filings reported to the Internal Revenue Service.

Can you defer payroll taxes and get a ppp loan. If the common law employer directs the CPEO or 3504 agent including a non-certified PEO or other third party payer that is designated as an agent by submitting Form 2678 or otherwise under the regulations under section 3504 to defer payment of any portion of the employers share of Social Security tax during the payroll tax deferral period then the common law employer will be solely liable for the payment of the deferred taxes. However on April 10 the IRS issued guidance clarifying that an employer may defer the employers portion of Social Security taxes until it actually receives a decision from its lender that its PPP loan has been forgiven. Once loan forgiveness has occurred the.

Payroll Tax Deferral Expanded In addition to PPP loan changes the bill allows all employers even those with forgiven PPP loans to defer the payment of 2020 employers Social Security taxes with 50 of the deferred amount being payable by December 31 2021 and the balance due by. Under the CARES Act employers can defer their payroll taxes from March 27 2020 through December 31 2020 even if your PPP loan has been forgiven. The guidance in the FAQs specifically states that employers may defer their payroll taxes up to the date of forgiveness of the PPP loan and then employers may continue to not pay that deferral until the repayment dates listed in the CARES Act half by Dec.

The CARES Act states that you must submit the following documents to your lender with an application requesting forgiveness for your PPP loan so you should make sure you are thinking in terms of documenting how you spend the loan proceeds. Its worth noting that the CARES Act also allows for some businesses to defer some of their payroll tax payments until the end of 2021. Among these changes business owners who take out a PPP loan and have that loan forgiven are now eligible to delay their payroll tax payments.

At that point the employer may. In the responses the IRS helpfully clarified that employers who receive a PPP loan but whose loan has not yet been forgiven may defer deposit and payment of the employers share of Social Security tax that otherwise would be required to be made beginning on March 27 2020 through the date the lender issues a decision to forgive the loan in the CARES Act without incurring failure to deposit. Defer Payroll Taxes Clarification from IRS.

The provision lets you defer payment of the employer share 50 of Social Security taxes on wages earned from March 27 2020 through Dec. 31 2021 and the balance by Dec. This has created uncertainty because many businesses have not received a PPP loan or are not sure if they can obtain the loan.

Under the Coronavirus Aid Relief and Economic Security CARES Act businesses are eligible to delay certain employer-paid payroll tax benefits. But if you have requested that deferment before applying to the loan those later due dates wont change back. The PPP Flexibility Act which was enacted on June 5 2020 changed the rules so employers can still defer these taxes even after a PPP loan is forgiven.

Are federal taxes included in the payroll costs used to calculate the maximum loan amount. However the CARES Act blocked businesses who have their PPP loan forgiven from availing themselves of this delay. Payroll costs are to be calculated on a gross basis without regard to federal taxes imposed or withholds such as the employee and employers share of FICA and income taxes withheld from employees.

Payroll tax deferral taxpayers with forgiven PPP loans - KPMG United States Legislative update. The payroll tax deferral provision does not apply if the employer obtained loan forgiveness under a PPP loan. Yes employers are allowed to defer payroll taxes as specified in the CARES Act from March 27 2020 through December 31 2020.

If you have received a PPP loan you wont be eligible to request deferred payroll tax due dates. Can I defer payroll taxes while also getting a PPP loan. Senate in the evening of June 3 2020 approved by voice vote the Paycheck Protection Program Flexibility Act of 2020 HR.

State income payroll and unemployment tax filings. Senate passes bill payroll tax deferral for taxpayers with forgiven PPP loans COVID-19 The US. You have to pay 50 of your deferred taxes from 2020 by December 31 2021 and the other 50 by December 31 2022.

The FAQs clarify that employers who obtain PPP loans may defer deposit of payroll taxes until such time that the employer receives a decision from its lender that all or any portion of their PPP loan is forgiven. Whether the employer would be eligible for loan forgiveness if payroll taxes were deferred. Or whether the employer could defer payroll taxes after the PPP loans were forgiven On April 10 the Internal Revenue Service IRS issued taxpayer-friendly guidance via FAQs that clarified these issues.

The biggest limitation on the ability of employers to defer payroll taxes under this provision is the Paycheck Protection Program PPP exclusion ie the payroll tax deferral provision does not apply if a taxpayer obtains loan forgiveness under a PPP loan. This payroll tax deferral was not a payroll.

Ppp Loan Forgiveness Just Became Easier Olsen Thielen Certified Public Accountants Consultants

Payroll Tax Deferral Opportunities For Employers Participating In Paycheck Protection Program Ppp Pya

Everything You Should Know About Ppp Loan Forgiveness Stratlign Your Expert Accounting Connection

Defer Employment Tax Deposits Under Ppp Loan Program Mfa Insights

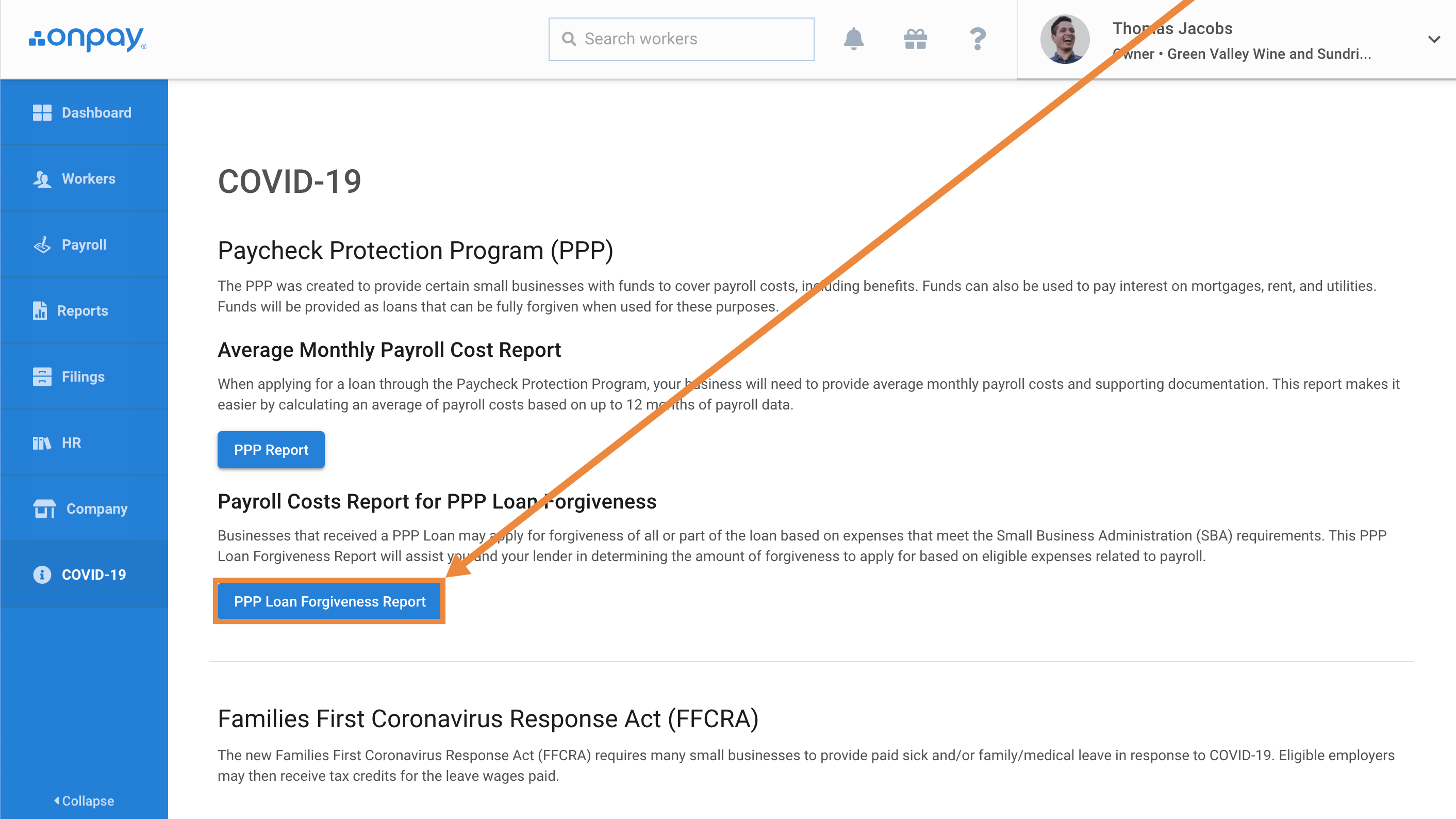

How To Run A Ppp Loan Forgiveness Report In Onpay Help Center

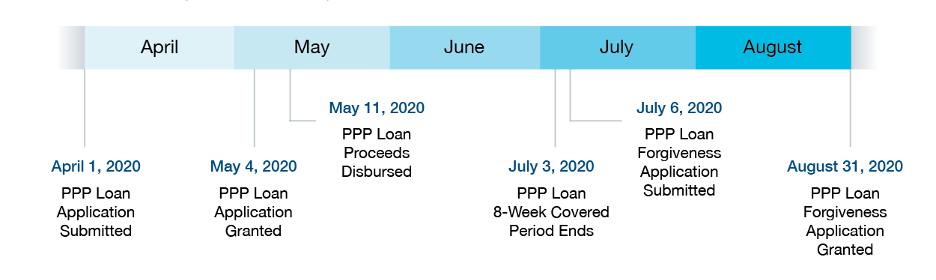

The Path To Ppp Loan Forgiveness Start Preparing Right Away Wiss Company Llp

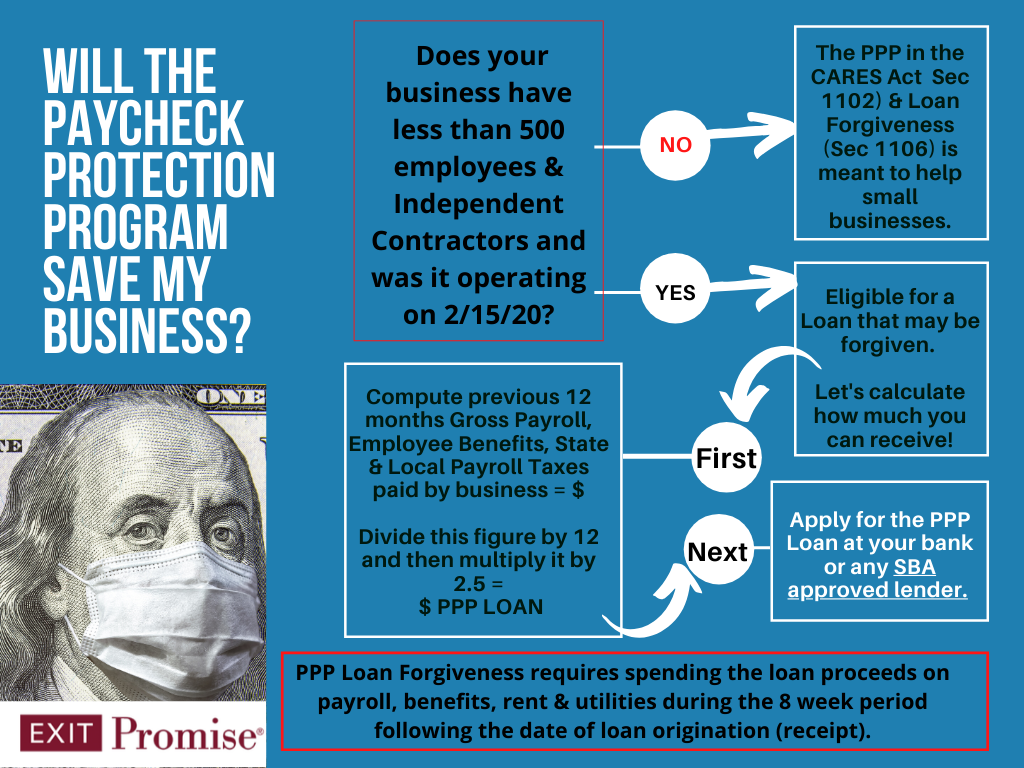

Ppp Loan Faqs For Small Business Small Business Trends Worldnewsera

How The Paycheck Protection Loans Work Exit Promise

Know About Ppp Loan Forgiveness For Loans Of 50 000 Or Less

Ppp Loan Forgiveness Guidance For Employers

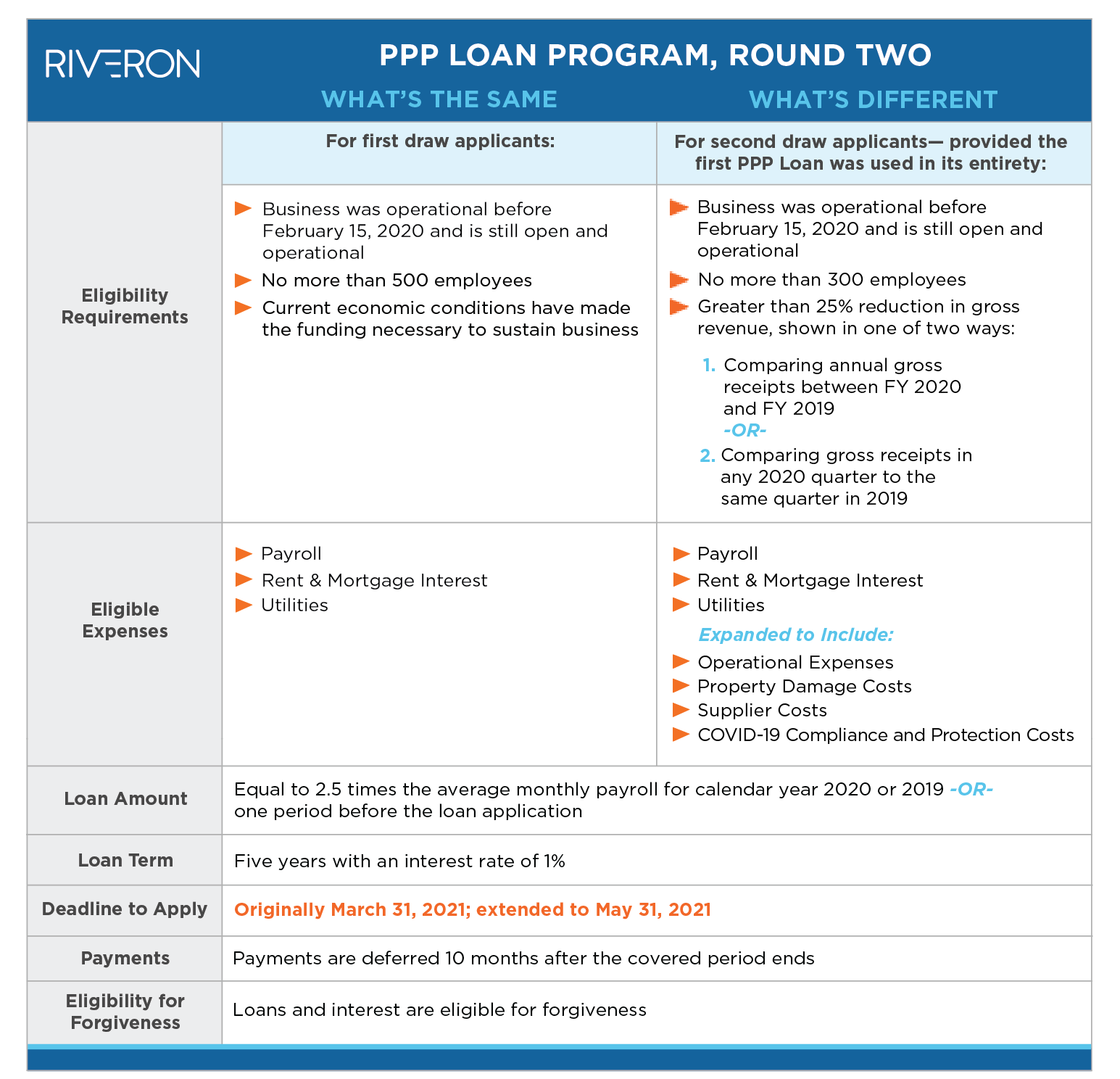

The Latest Round Of Ppp Loans Accounting And M A Considerations Riveron

Ppp Loan Forgiveness Resources

So You Received Your Ppp Loan Awesome Wow What Comes Next Do You Have A Clue What Happens Now With Apologies To Lin Manuel Miranda Forrest Firm

Ppp Loan Forgiveness Guide Business Advisory Kirsch Cpa Group

Ppp Loan Update Mitchell Wiggins

Extended Ppp Loan Round 2 Application Deadline

Uncategorized Archives Tax Management Financial Horizons

Small Business Advice For Business Owners On Ppp Loan Forgiveness Bloomberg

Post a Comment for "Can You Defer Payroll Taxes And Get A Ppp Loan"