Is There A Limit On Employer Social Security Tax

Employers may voluntarily elect to defer the employee portion of the social security tax 62 of wages for wages paid between September 1 2020 and December 31 2020. The employer must remit both the amounts withheld from employees wages and the employers matching amount to the.

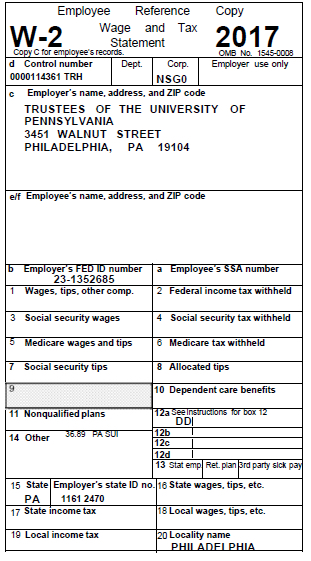

Tax Forms For 2017 University Of Pennsylvania Almanac

In 2021 this limit is 142800 up from the 2020 limit of 137700.

Is there a limit on employer social security tax. The 2021 Social Security wage base is 142800. The earnings limit is called the Social Security Wage Base and it typically goes up every year. Since employees also have the Social Security payroll tax withheld from their wages salaries etc the employer is in effect matching each employees Social Security payroll tax.

For 2020 the SS wage base is 137700. Hence the maximum amount of the employers Social Security tax for each employee in 2021 is 885360 62 X 142800. Lets say an employees.

Refer to Whats New in Publication 15 for the current wage limit for social security wages. As a result in 2021 youll pay no more than 885360 142800 x 62 in Social Security taxes. This means that the maximum Social Security tax deducted from an employees wages will be 853740 62 percent of 137700.

If You Work More Than One Job Keep the wage base in mind if you work for more than one employer. 31 2020 with half of the deferred amount due by Dec. If you are under full retirement age for the entire year we deduct 1 from your benefit payments for every 2 you earn above the annual limit.

Employers cannot honor the Social Security wage cap for wages paid to a current employee by a former employer. Officially known as the wage base limit the threshold changes every year. You arent required to pay the Social Security tax on any income beyond the Social Security Wage Base.

The deferral of deposits of the employer portion of Social Security tax was established by the CARES Act as applicable only to deposit deadlines from March 27 to Dec. For 2021 that limit is 18960. Social Security Tax Limit.

In other words employers are only responsible for withholding and paying Social Security tax on. 8 Zeilen If you are working there is a limit on the amount of your earnings that is taxed by Social. After their income hits a certain level their Social Security withholding stops for the year.

Or Publication 51 for agricultural employers. The contribution percentages are limited to a certain income cap. Only withhold and contribute Social Security taxes until an employee earns above the wage base.

However your current employer is still require to withhold and pay Social Security taxes up to the annual wage base limit for wages paid to you even if youve reached the limit for the year with a prior employer. What Is the Social Security Tax Limit. In 2020 the limit is 137700.

The wage base limit is the maximum wage thats subject to the tax for that year. Likewise stop withholding the employees portion when they earn above this threshold. Stay up-to-date with the annual Social Security wage base because it generally changes each year.

Unlike the other FICA taxes the 09 percent Medicare surtax is not withheld unless wages paid to an employee exceed 200000. There is no requirement that employers do so and there is no penalty if employers choose not to do so. Wage Base Limits.

Stop paying the 62 Social Security tax rate if an employee earns above the Social Security wage base. In 2021 the Social Security tax limit is 142800 up from 137700 in 2020. Employees pay a matching 62.

However there is no annual dollar limit for the 145 percent Medicare tax. This is the largest increase in a decade and could mean a higher tax bill for some high earners. If the employee earns more than 137700 no Social Security tax will be deducted from.

For Social Security taxes there is a maximum dollar amount that serves as a wage cap. For taxes due in 2021 refer to the Social Security income maximum of 137700 as youre filing for the 2020 tax year. The 2020 Social Security wage base is 137700.

Employers must pay a flat rate of 62 of each employees wages for Social Security tax. 31 2021 and the other half due by Dec. Only the social security tax has a wage base limit.

The 2021 wage limit for. The annual rise began in 1972 when the wage base was 9000. For earnings in 2021 this base is 142800.

Wage Caps and Floors The Social Security tax also called OASDI is subject to a dollar limit which is adjusted annually for inflation. We use the following earnings limits to reduce your benefits.

Social Security Wage Base Increases To 142 800 For 2021

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

What Are Employee And Employer Payroll Taxes Ask Gusto

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Https Csvcpas Com Wp Content Uploads 2021 01 Payroll Tax Letter 2021 Pdf

What Is Fica Tax Contribution Rates Examples

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

What Is Fica Tax Contribution Rates Examples

Understanding Your W 2 Controller S Office

What Are Employee And Employer Payroll Taxes Ask Gusto

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Post a Comment for "Is There A Limit On Employer Social Security Tax"