Washington State Employment Security Taxable Wages

Washington State Unemployment Insurance varies each year. Salaries shown are the latest final data available from the Office of Financial Management.

The Dual Tax Burden Of S Corporations Tax Foundation

Income you have in excess of 200000 single filers 250000 joint filers or 125000 married people filing separately is subject to an additional 09 Medicare surtax which your employer wont match.

Washington state employment security taxable wages. This annual limit is called the contribution and benefit base. Experience tax currently capped at 54 RCW 5029025 Annual tax calculation based on the ratio of benefit claims of former employees charged to the employer and taxable wages reported by. Starting January 1 2022 ESD will assess each Washington employee a 058 premium assessment based on their wages.

However the Washington unemployment tax. The taxable wage base is the maximum amount on which you must pay taxes for each employee. For 2021 the wage base is 56500.

You pay unemployment taxes on your employees gross wages up to the taxable wage base. Excluded Employment The information provided in this. Tips reported by the employee.

The rate is calculated each year based on average wages in Washington. The Departments unemployment tax rates for 2019 are expected to be finalized in December. SecureAccess Washington allows Internet access to multiple government services using a single username and password.

Washington state employers like employers in every other state must withhold social security and Medicare taxes from employee wages. The definitions of employer and worker used for workers compensation purposes are located in Appendix A. Rates also change on a yearly basis ranging from 011 to 540.

This handbook is based on current UI legislation. From general tax revenues. All Washington workers must be covered through the State Fund or by a certified self-insured employer unless they are subject to an exclusion listed in the next section.

Download Data InformationFAQ Personnel Included Specific Government Positions. Statements are intended for general information and do not have the effect of law. Find more information about.

Tax reports or tax and wage reports are due quarterly. The Department also announced that effective with new claims filed on or after July 1 2019 the minimum weekly unemployment benefit. The wage base takes effect Jan.

The amount each employee was paid for working whether paid as a fixed salary hourly pay or overtime. The Washington Employment Security Department announced today that the unemployment taxable wage base is set to rise to 49800 in 2019 up from 47300 in 2018. If you hire someone to perform domestic services in a private home college club fraternity or sorority you do not report until you pay wages of 1000 or more per quarter.

However you still have to factor in Unemployment Insurance and Workers Compensation Tax. This taxable wage base is 56500 in 2021 increasing from 52700 in 2020. The Washington state Employment Security Department has produced this handbook to help employers comply with Washington state Unemployment Insurance UI law and to promote understanding of the overall UI program.

Federal unemployment tax rates apply to all applicable employers in the United States. For earnings in 2020 the Social Security taxable wage base is 137700. Social Securitys Old-Age Survivors and Disability Insurance OASDI program limits the amount of earnings subject to taxation for a given year.

The Internal Revenue Service collects federal unemployment tax and the Washington State Employment Security Department collects state unemployment tax. Employers then match those percentages so the total contributions are doubled. This limit is adjusted each year with changes in the national average wage index.

When paid vacation or holidays earnings are reportable. Social security tax is 565 percent of each employees income up to 106800 as of 2011. Workers have to pay 145 of their wages for the Medicare tax and 62 for the Social Security tax.

Once youre signed in you can change your password and access various government services. SUTA is paid on wages and other compensation up to a maximum per employee during each calendar year the taxable wage base is 56500 for 2021. In Washington State.

You may have created a SAW account to pay your LNI premium or unemployment insurance taxes. The rate may be adjusted every two years but cannot be greater than 058. If you have no employees and no payroll for the quarter you must file a no-payroll report.

Income exceeding this amount is exempt. Data for the University of Washington are being updated. The employer must collect this premium assessment through a payroll deduction and remit the proceeds to ESD.

If your payroll reaches 1000 in any quarter you must report wages for the entire year. If you have employees working in Washington you likely must pay unemployment taxes on their wages in this state. What you pay unemployment taxes on.

Use the tax rate provided to you by the Washington Employment Security Department. Most employers in Washington are required to pay federal and state unemployment taxes on a certain amount of wages paid to employees for the year. This handbook is not designed to.

The Washington Employment Security Department announced that due to a 55 increase in the average annual wage for 2018 the state unemployment insurance SUI taxable wage base will increase to 52700 for calendar year 2020 up from 49800 for 2019. Liable employers must submit a tax report every quarter even if there are no paid employees that quarter andor taxes are unable to be paid.

Sui Sit Employment Taxes Explained Emptech Com

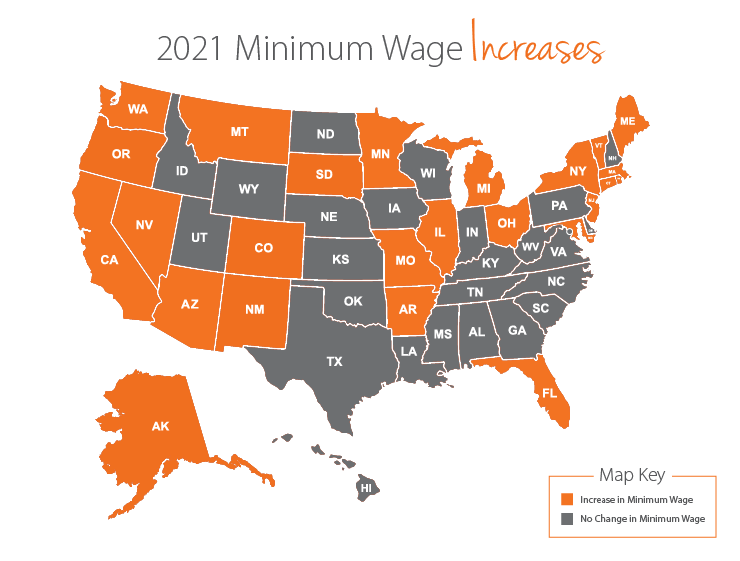

Minimum Wage By State 2021 Increases Vs 2020 Paycor

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms Income Tax W2 Forms

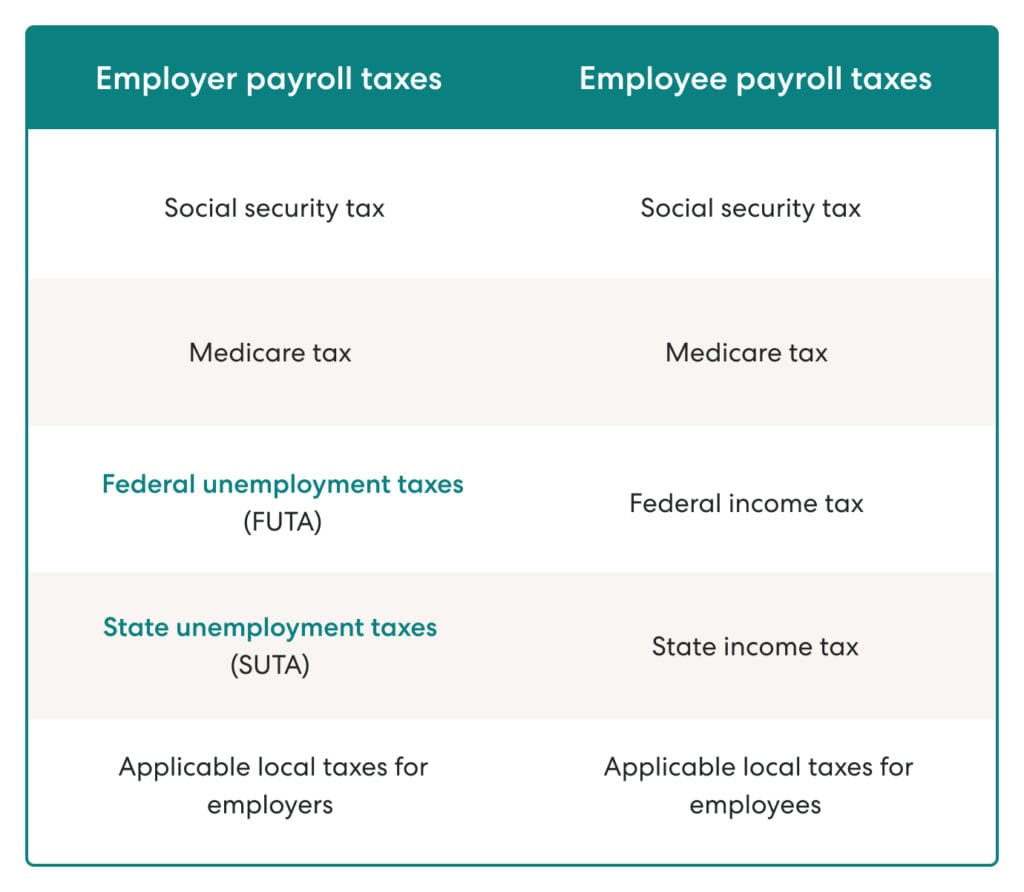

What Are Employee And Employer Payroll Taxes Ask Gusto

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

State Tax Revenue Soars In Second Quarter Of 2013 State Tax Revenue Tax

Federal Revenue From Capital Gains Taxes Fell Sharply During The Recession Down 100 Billion From 2007 To 2009 Rates Are Capital Gain Capital Gains Tax Gain

Collective Bargaining As A Path To More Equitable Wage Growth In The United States Equitable Growth

What Are Quarterly Wage Reports And Why Do They Matter Smallbizclub

Kowalski Przemyslaw Max Buge Monika Sztajerowska And Matias Egeland 2013 State Owned Enterprises Trade Effects And Pol Enterprise States Baltic States

Understanding Your Pay Statement Office Of Human Resources

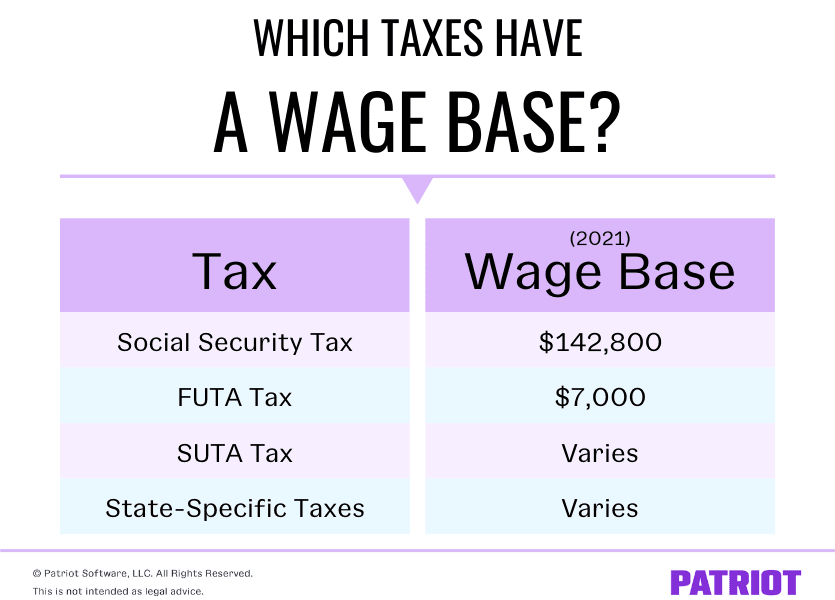

What Is A Wage Base Definition Taxes With Wage Bases More

2020 Instructions For Schedule H 2020 Internal Revenue Service

Where Does Your State S Minimum Wage Rank Against The Median Wage Equitable Growth

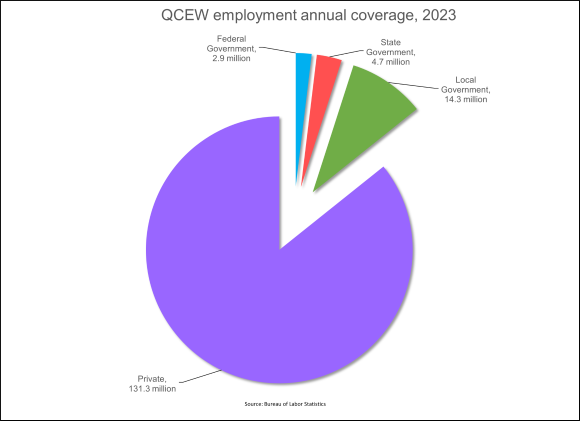

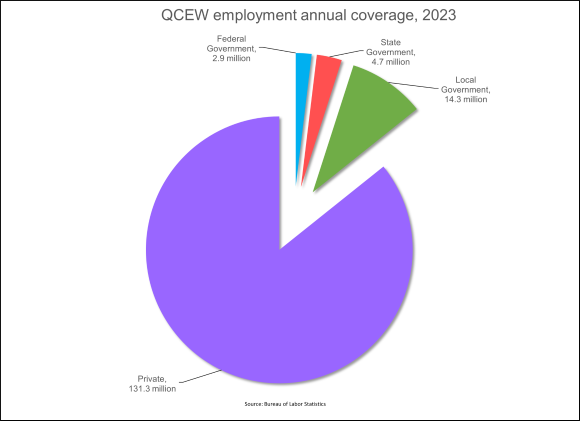

Employment And Wages Annual Averages 2019 U S Bureau Of Labor Statistics

Sui Sit Employment Taxes Explained Emptech Com

Publication 926 2021 Household Employer S Tax Guide Internal Revenue Service

Everything You Need To File Your Taxes For 2020 W2 Forms Tax Forms Irs Tax Forms

How Unemployment Benefits Are Calculated By State Bench Accounting

Post a Comment for "Washington State Employment Security Taxable Wages"