What Is An Income Tax Warrant

We file a tax warrant with the appropriate New York State county clerks office and the New York State Department of State and it becomes a public record. If you receive a compensatory warrant you are not taxed on the receipt of the warrant as long as the warrant is priced at fair market value.

Income Tax Notices Issued By Income Tax Department Learn Itr

For this reason tax creditors pose a unique threat to your property.

What is an income tax warrant. The lien encumbers all real and personal property used in the business and owned by the taxpayer. Tax warrants precede all forcible collection actions including levies income executions and property seizure. The difference between the strike price and the price of a share.

When a tax warrant is filed with the Superior Court in the county where the taxpayer owns real or personal property a lien is created. The compensatory warrant is a warrant issued for services. This not only creates a public record of the tax debt but also creates a lien on your real and personal property such as cars homes and cash in your bank accounts.

Whether you owe taxes to New York State or New York City New York State will enforce the tax warrant under the tax law. In these instances your profits will be subject to income tax. This paper examines the income tax consequences of warrants for traders speculators hedgers whether they are individuals trusts or companies as well as complying superannuation funds collectively referred to as an investor or investors.

Most state tax liens work similarly to an IRS lien. If you wait too long you might forfeit certain rights and privileges. Your total investment is thus 2400.

A tax warrant is equivalent to a civil judgment against you and protects New York States interests and priority in the collection of outstanding tax debt. Australian residents are assessable on their worldwide income. For example say you exercise warrants with a strike price of 20 per share to buy 100 shares of XYZ and you originally paid 400 for the warrants.

A tax warrant creates a lien against real and personal property and gives the state law enforcement officers or tax officers the ability to enforce all other collection actions. A tax lien also called a tax warrant sets the stage for a foreclosure lawsuit. Circumstances in which Income Tax Search Warrant with details of Authority and Premises and Person against whom same can be issued.

The tax warrant typically is filed in every county where you have property. Relevant Extract of section 132 of the Income Tax Act 1961. Also called a lien the warrant is a public record that allows the government to claim your personal property or assets to satisfy the unpaid taxes.

If the market price on the day of exercise is 40 the. In this section well examine the capital gains tax implications of buying and selling options and warrants as its these tax rules that will apply most often. A tax warrant is a document that the department uses to establish the debt of a taxpayer.

A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. Warrants issued for services are taxed just like compensatory stock options. What is a State Tax Lien or State Warrant.

Exercising stock warrants results in taxable income that amounts to the difference between the strike price and the price of a share minus the cost basis. Due to laws protecting the state and federal government tax creditors possess special rights. Introduction to Search Warrant under Income Tax Act.

The income tax consequences will depend among other things on the tax residency of the taxpayer. They may also affect a taxpayers credit rating and can impact future borrowing and sales capabilities. What is a tax warrant.

If you fail to pay your state taxes or resolve the past due balance within a reasonable time the tax bureau in your state likely will issue a tax warrant in your name. The warrant is filed with the Clerk of Court and is a. If you have unpaid taxes and have received notification of a tax warrant heres what you need to know.

If youre buying and selling options frequently the normal share matching rules will apply provided the options are of the same class and series in other words. When you exercise however any spread is taxable as ordinary income. A tax warrant acts as a lien against real and personal property you own in the county in which it is filed.

For those warrants that are not considered compensatory the investment warrant rules generally apply. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed. A person in possession of the Asset or owner of the asset.

Each state also has its own rules on how they can be released removed discharged or subordinated. A NYS tax warrant is a judgment against you that is filed by either New York State or NYC as a result of owed back taxes. Persons against whim Search Income Tax Warrant can be issued-i.

The tax treatment of warrants depends on whether the warrant is issued with equity or in the nature of compensatory warrants. However they all have their own set of rules when it comes to liability amounts they will file them. States also use various names for liens one common term is a tax warrant which is the equivalent of a tax lien.

When you exercise warrants to buy the underlying stock you pay the stated strike price to the issuing company. So if you want to avoid foreclosure take care of tax liens as quickly as possible.

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Hmrc Tax Refund Revenue Security Companies

Income Tax Deductions Chart All Assessment Years Indiafilings

Granger Art On Demand Art Prints Posters Home Decor Greeting Cards And Apparel Granger Federal Income Tax Art

Provision For Income Tax Definition Formula Calculation Examples

1925 Swansea Pwllbach Tirbach Brynamman Anthracite Collieries Ltd Colliery Swansea Paper Ephemera

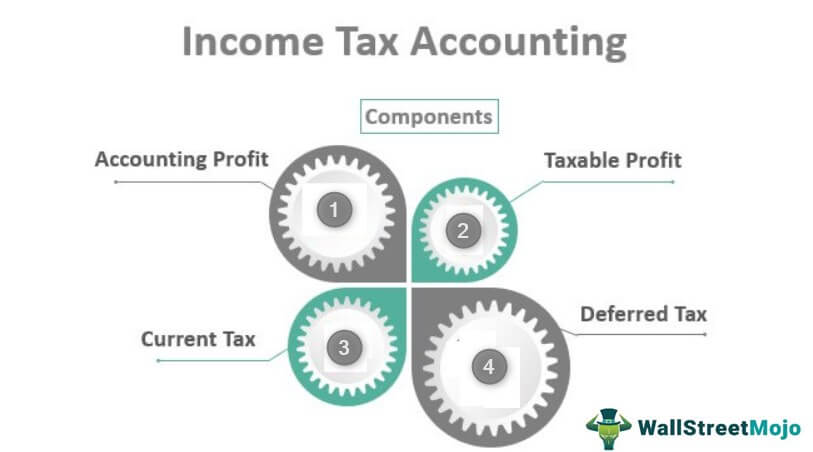

Income Tax Accounting Definition Examples Step By Step

Section 282a Of Income Tax Issue Of Income Tax Notice Indiafilings

Income Tax Survey Meaning Applicability Income Tax Act Indiafilings

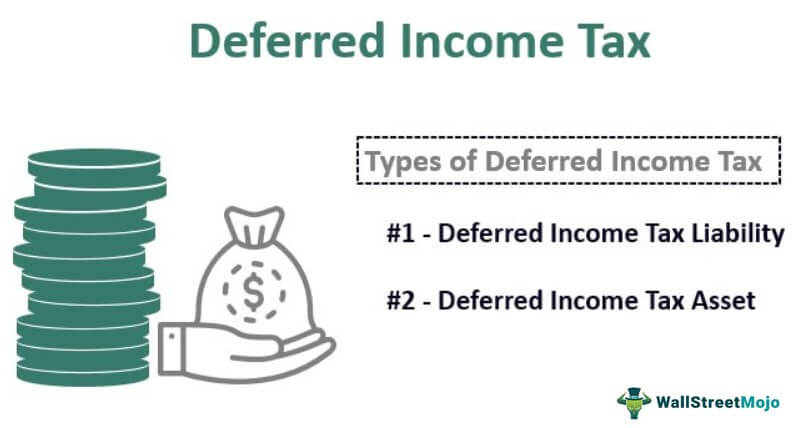

Deferred Income Tax Definition Example How To Calculate

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Bra Extends Personal Income Tax Filing Deadline Barbados Today In 2021 Filing Taxes Tax Filing Deadline Income Tax

Income Tax India Guide For Tax Payers Tax Types It Return Payment

Proportional Tax Definition Example How To Calculate Proportional Tax

Rectification Of Mistake Section 154 Income Tax Some Issues

The Kidderminster Brewery Company Ltd 1908 Stock Tax Receipt Kidderminster Brewery Receipt

Provision For Income Tax Definition Formula Calculation Examples

Income Tax India Guide For Tax Payers Tax Types It Return Payment

Post a Comment for "What Is An Income Tax Warrant"